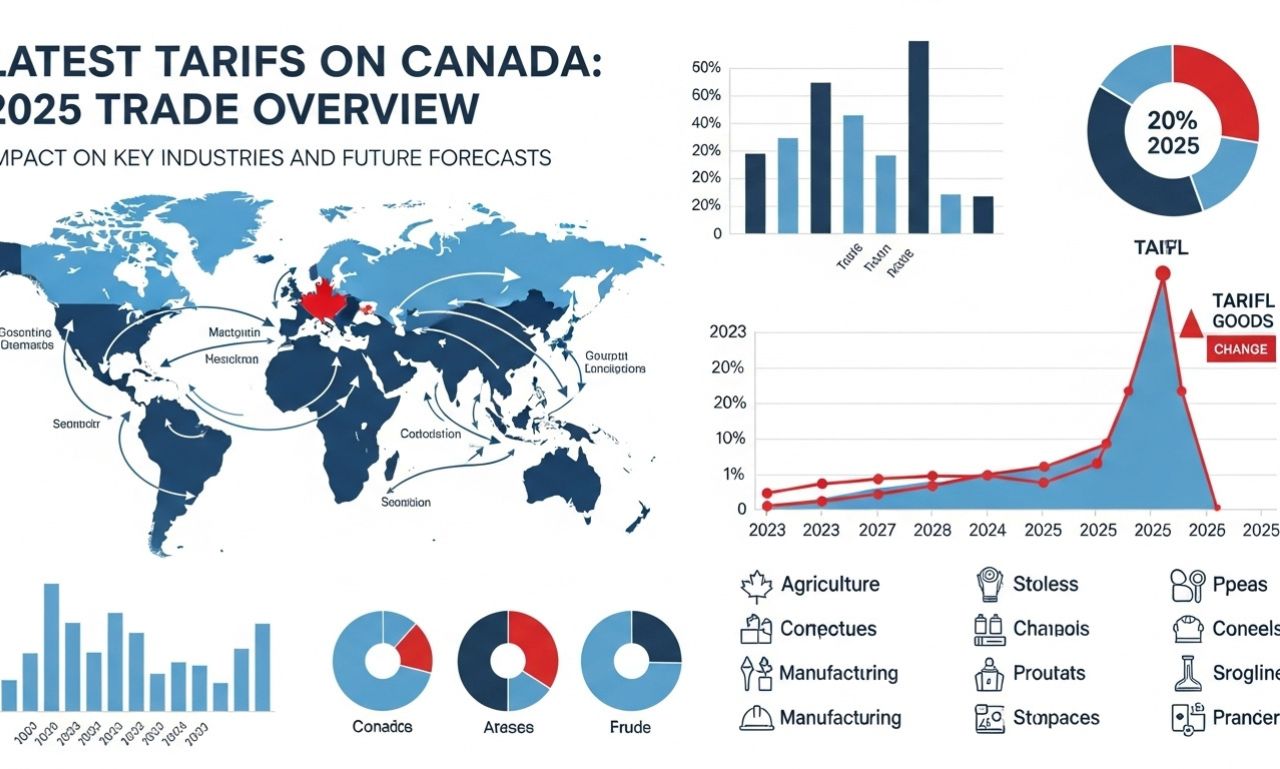

Tariffs on Canada have surged back into global attention. In 2025, a sharp escalation in trade tensions between Ottawa and Washington led to sweeping duty increases on both sides of the border. These measures—designed as retaliation and protection—are affecting industries ranging from metals to manufacturing. This article provides an in-depth look at the latest tariffs on Canada, their origins, their economic impact, and what businesses should prepare for.

Why Tariffs on Canada Are Back in Focus

The renewed focus on tariffs on Canada stems from a significant trade confrontation initiated by the United States. Citing economic security interests, the U.S. imposed heavy duties on a wide range of Canadian goods, most notably in the steel and aluminum sectors.

Canada responded firmly. In early March 2025, the Canadian government imposed a 25% tariff on roughly C$30 billion worth of U.S. imports. Days later, a second round extended these duties to nearly C$29.8 billion more goods. These actions form one of the largest and most strategic tariff responses in Canadian history.

Key Elements of Canada’s 2025 Tariff Strategy

1. Rates and Scope of Countermeasures

Canada’s tariff response revolves around a uniform 25% duty on a wide catalogue of U.S. goods. The two-phase rollout targeted materials, manufactured goods, machinery, and food-related products. A substantial portion of these countermeasures specifically targeted steel (C$12.6 billion worth) and aluminum (C$3 billion worth).

Canada also introduced a remission process, providing tariff relief for businesses that can demonstrate hardship or lack of supply alternatives. While helpful in some cases, the approval process is selective and not all goods qualify.

2. Tariff-Rate Quotas for Foreign Steel

In June 2025, Canada implemented tariff-rate quotas (TRQs) for steel imports from non-free-trade-agreement countries. The TRQs apply to five major categories of steel mill products. When imports exceed the defined quota, a severe 50% surtax is triggered.

Even countries with free trade agreements face adjusted quotas, although with more flexible thresholds compared to non-FTA partners.

Beginning July 31, 2025, a 25% surtax also applies to steel and aluminum products containing Chinese-melted or smelted metal—an additional measure designed to prevent tariff circumvention through complex supply chains.

The U.S. Side: Tariffs on Canadian Exports

To fully understand tariffs on Canada, one must examine the U.S. measures that prompted Ottawa’s response.

Key U.S. tariffs affecting Canada include:

-

A 50% duty on Canadian steel and aluminum.

-

A 25% tariff on motor vehicles and auto parts not meeting Canada–U.S.–Mexico Agreement (CUSMA) content rules.

-

A 25% tariff on various imported goods that fail to meet CUSMA compliance, with some exceptions—such as energy and potash, which face a 10% tariff.

These measures directly pressure major Canadian export industries and complicate cross-border supply chains.

Economic and Business Impact of Tariffs on Canada

A. Impact on Canadian Businesses

The rising tariffs on Canada have increased operational costs for thousands of businesses. Companies importing U.S. goods—particularly materials, agricultural inputs, and machinery—are experiencing significant price hikes.

Small and medium-sized enterprises are particularly vulnerable. Without the ability to absorb or offset increased costs, many face reduced margins or must adjust prices. The remission process offers partial relief, but only for a limited set of products and under strict eligibility conditions.

B. Macroeconomic Risks in tariffs on Canada

Canadian economic forecasts now incorporate the assumption that U.S. tariffs will persist for the foreseeable future. These trade barriers have created a climate of uncertainty, discouraging investment in affected sectors such as automotive manufacturing, steel production, and heavy industry.

Additionally, prolonged tariff pressure may contribute to inflation if higher import costs translate to increased consumer prices.

C. Push for Trade Diversification in tariffs on Canada

Rising tariffs on Canada have accelerated the push toward trade diversification. Canadian firms are exploring markets outside North America, and some are reshoring or near-shoring production to reduce exposure to trade volatility. Diversification, however, requires time and investment—challenges that many businesses are still grappling with.

Political and Strategic Dimensions at tariffs on Canada

1. Negotiation Leverage

Canada’s retaliatory tariffs are designed not only as countermeasures but also as bargaining tools. Ottawa is using the tariff pressure to signal its unwillingness to accept one-sided trade penalties and to push for more balanced trade discussions with Washington.

2. Reaction Within Canada

Many Canadians support the government’s firm stance, viewing it as a defense of national economic interests. However, business groups—especially small import-reliant companies—argue that the domestic burden is disproportionately heavy.

The government must therefore strike a delicate balance: protecting national industries without destabilizing consumer prices or business viability.

3. Global Ripple Effects

Because Canada is a major global supplier of commodities such as steel, aluminum, and agricultural goods, its tariff actions are watched closely by other countries. Some may adjust their own trade policies or rebalance alliances as a result of these tensions.

Risks and Challenges Ahead

-

Escalation Risk: Future rounds of tariff increases on either side could intensify economic damage.

-

Supply Chain Strain: Canada’s manufacturing sector relies heavily on cross-border inputs, making long-term tariffs costly.

-

Inflation Pressures: Higher import costs could feed into consumer prices.

-

Diversification Barriers: Shifting suppliers and markets requires capital, research, and new logistics networks.

-

Political Volatility: Election results in either country may alter tariff strategies unpredictably.

Opportunities Emerging from the Tariff Environment

Even in the midst of tariff pressures, some opportunities are emerging:

-

Domestic Industry Growth: Increased incentives for local production may strengthen Canadian manufacturing.

-

New Trade Partnerships: Canada may deepen ties with Europe, Asia, and other regions.

-

Innovation: Companies seeking to offset higher costs may invest in automation and advanced technologies.

-

Strategic Influence: Tariffs can serve as leverage in broader economic negotiations.

What Businesses Can Do Now

To navigate the environment shaped by tariffs on Canada, businesses should:

-

Evaluate Supply Chains: Identify vulnerabilities and seek alternative sources where possible.

-

Apply for Remission: Explore tariff relief options in categories where exemptions may be available.

-

Adjust Pricing Strategies: Implement methods to manage increased import expenses.

-

Explore New Markets: Look beyond the U.S. for both imports and exports.

-

Influence Policy: Engage industry associations to voice concerns and shape future tariff rules.

Looking Ahead: The Future of Tariffs on Canada

The long-term trajectory of tariffs on Canada will depend on political negotiations, economic priorities, and global trade dynamics. Key observations include:

-

Diplomatic negotiations are likely, but resolution may be gradual.

-

Canada’s remission system may evolve into a more flexible tool for business support.

-

Persistent tariffs could reshape supply chains and accelerate Canada’s diversification strategy.

-

The fallout of the 2025 trade tensions may have lasting consequences for North American trade patterns.

Conclusion

Tariffs on Canada have become a defining feature of the 2025 economic environment. What began as targeted U.S. duties has expanded into a broad and strategic Canadian response. The result is a complex landscape of economic risks, political maneuvering, and emerging opportunities. For businesses and policymakers, understanding and adapting to these changes is essential. In the long run, these tariffs may transform how Canada trades, competes, and positions itself in the global economy.